From interest rates and inflation to the job market and recession, we anticipate there will be a number of shifting elements in the economy for the remainder of the year and potentially into 2024. At the May meeting this year, the Fed increased its policy rate for the tenth consecutive time, pushing the upper bound of the fed funds rate to 5.25%, the highest since August 2007. The Fed’s aggressive rate-hiking campaign has been a focus for investors for over a year. Frankly, investors are probably ready to move on from the Fed being the centerpiece of most conversations.

We expect the Fed to change strategy during the latter half of 2023 for at least two reasons. First, the Fed should have less pressure to react to a tight labor market as the job market is set to cool throughout the remainder of the year. And second, the Fed will likely be less concerned inflation could get out of control from sticky-services inflation, since we expect services prices to ease. One nagging inflation component that will ease in the coming months is rent, as a record number of new apartment units under construction will dampen rent prices. Expect investment opportunities in firms related to multi-family and mixed use projects.

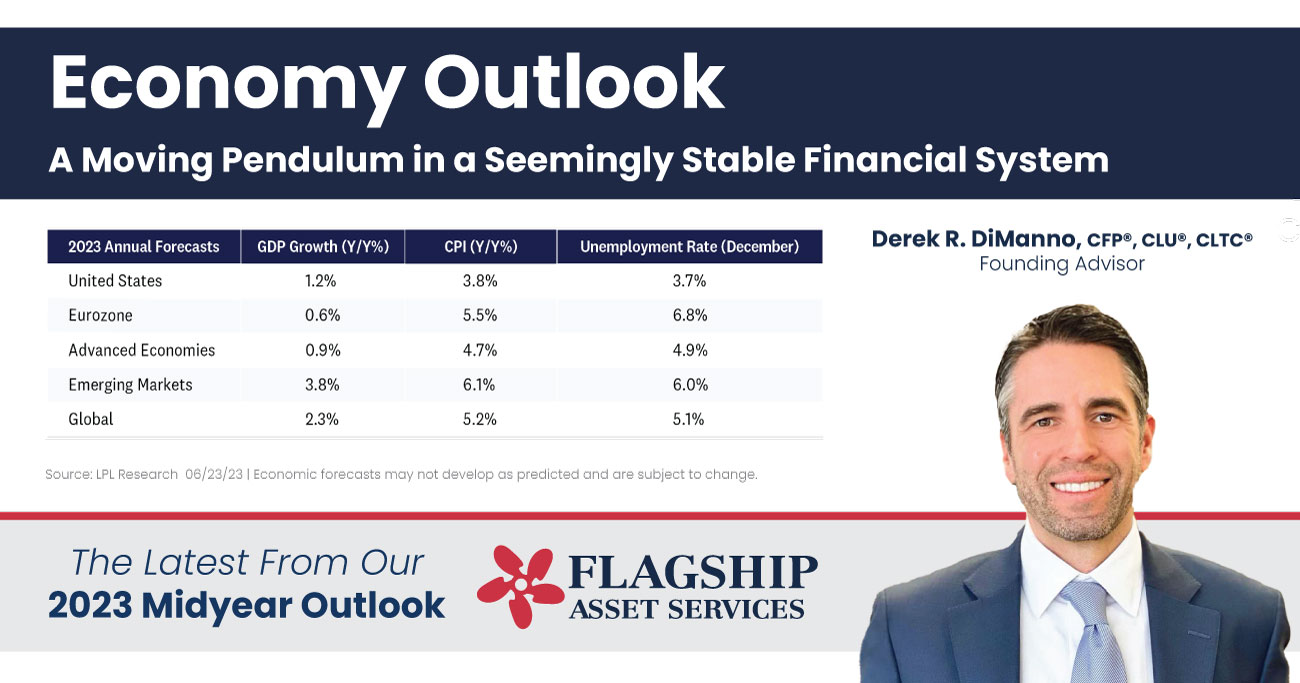

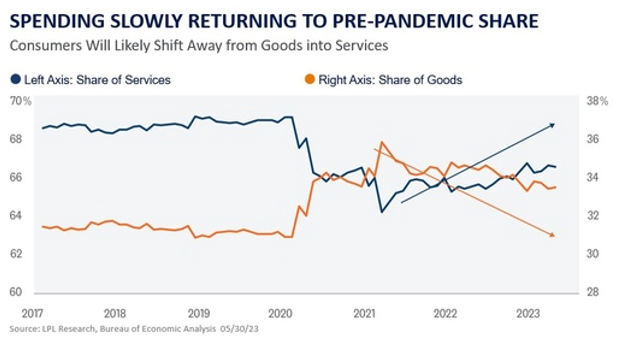

Investors will likely shift focus from central bankers to consumers. We expect less focus on tightening monetary policy and more on recession risk. The baseline forecast is the domestic economy slides into recession. However, solid growth in the first quarter and a potential recovery in the last few months of the year put annual U.S. growth close to a 1% forecast, outpacing the Eurozone [Image Below]. If job growth cools and the unemployment rate rises, consumers will likely experience declining disposable income, which could be the impetus for a recession as consumers pull back on spending. In the near term, consumers are still unleashing pent-up demand for services, especially within the leisure and hospitality sectors. But when the spending splurge ends, investors should expect some weakness in the consumer discretionary space.

Softer Job Market Should Cool Inflation

One theme likely to emerge during the remainder of this year is a softening job market. We expect the small business sector will play a key role in the weaker trajectory.

Small businesses hunkered down throughout recent months as the business outlook weakened. The National Federation of Independent Business (NFIB) reported few businesses planned to expand as credit conditions tightened, pulling small-business optimism down to its lowest level since January 2013. As it relates to the inflation outlook, fewer businesses plan to increase employment as firms cut back on labor costs [Image Below]. Small businesses account for roughly 45% of the U.S. economy and are showing signs of stress. Despite a robust labor market during the first half of this year, metrics point toward a broad slowdown in the labor market in the latter half. As inflation eases, the Fed will likely have more leeway to pause and perhaps cut rates by the end of this year if the economy slides into recession.

Multi-Family Housing Should Ease Rent Inflation

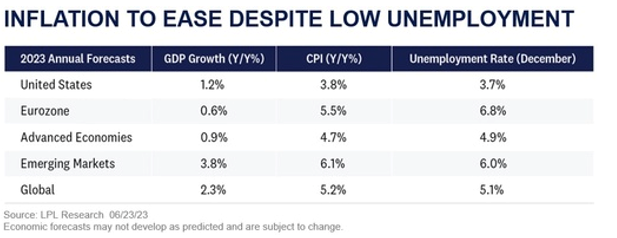

It’s no surprise residential activity is slowing. The housing market is coming off a euphoric run during the post-pandemic period of historically low interest rates, although the slowing housing activity does not look as bad when compared with 2019. Still, housing starts were more than 6% above November 2019 levels, illustrating this unique cool-down period amid a nationwide housing shortage. Rising borrowing costs and hesitant home builders could worsen the nationwide housing shortage in the near term, as activity likely cools further.

Higher mortgage rates and uncertain economic prospects impacted the housing market and will continue to depress housing in the months ahead. As home sales stalled in recent months, housing starts and permits have also slowed down. But that’s just at the aggregate level. Housing activity for multi-family dwellings has been growing for the past few years as builders respond to the acute shortage within this sector. Single-family construction spending has consistently shrunk over the last several months but building activity for 5+ units has maintained its uptrend. The increase in multifamily units is in stark contrast to the decline in single-family units under construction [Image Below].

It’s a tale of two residential construction economies. Construction activity for single-family homes is shrinking, but apartment and condo construction spending is on the rise. The diverging trends will likely attract investors’ attention. Construction firms with a diversified portfolio should be able to weather any upcoming economic storm better than firms focused on single-family home building. The recent trends will also affect inflation this year. Roughly 1 million apartments were under construction as of April, which is roughly three times the amount from 10 years ago. Increased supply in multi-family construction should ease future rent prices as vacancy rates rise. Industry data already shows declining rent prices, so it’s just a matter of time before the official government statistics reflect that easing. Investors and policymakers alike should expect a softening in housing-related inflation in the coming months.

China Unlikely to Drive Global Inflation

We’ve shared a domestic-focused outlook on inflation and growth. But China, and any global consumer price inflation we see as a result of it reopening and the ensuing oil demand, is an important component of the outlook as well. China’s economic recovery after three years of lockdowns was expected to drive a large share of global inflation in 2023. The increase in household savings during the pandemic was expected to unleash a large amount of pent-up demand. Since China accounts for roughly 20% of global oil imports, the Chinese economy was seen as a potential impetus for a global inflation shock for the global energy markets in 2023. According to the Conference Board, China’s reopening could add 0.30 to 0.65 percentage points to global inflation. While Chinese economic growth improved in early 2023, it has so far failed to live up to expectations, as investors have lingering concerns over the Chinese property sector and mounting recession risks among China’s key trading partners.

All things said, it’s too early to completely dismiss the potential inflationary impulse from China. The Asian tiger is still on track to import a record amount of crude in 2023 and a case can be made that recovery impact has quite a long lag time.

Last Remnants of Pent-Up Demand

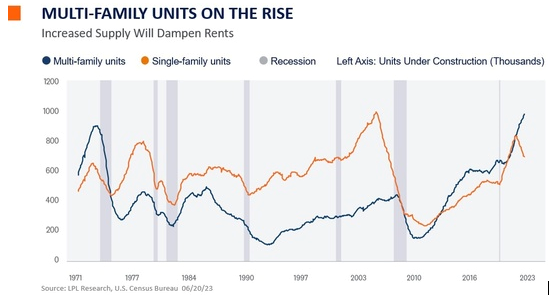

A notable consequence of the pandemic was the seismic shift in consumer spending patterns. When state and local governments issued stay-at-home orders, consumers reallocated their spending from services to goods. Even though the economy is a few years past the onset of the global pandemic, consumers have not yet returned to a pre-pandemic mix of services spending and goods spending. The process of returning to this roughly 70-30 mix has broad inflation implications. In the near term, demand for services will remain notable as consumers return to more normal spending patterns [Image Below].

Key Takeaways

The Fed seems to be shifting to a “wait and see” strategy as the banking sector remains tenuous, consumers are slowing spending activity, and the inflation outlook looks promising for the rest of the year. It’s possible investors may not see another rate hike during this cycle. Further, banking risks seem contained and the broad financial system appears stable. We also expect consumers will have outsized demand for experiences in the remaining months of the year, offsetting the decline in goods spending as consumer spending slows while helping to mitigate a potential economic contraction. Unless economic conditions change materially, the Fed has communicated a likely July hike, whether the economy needs it or not. But as inflation convincingly cools, markets will likely respond favorably to a slight pivot in Fed policy.

We hope this information was helpful. Stay tuned for more updates from the midyear outlook over the next few weeks.