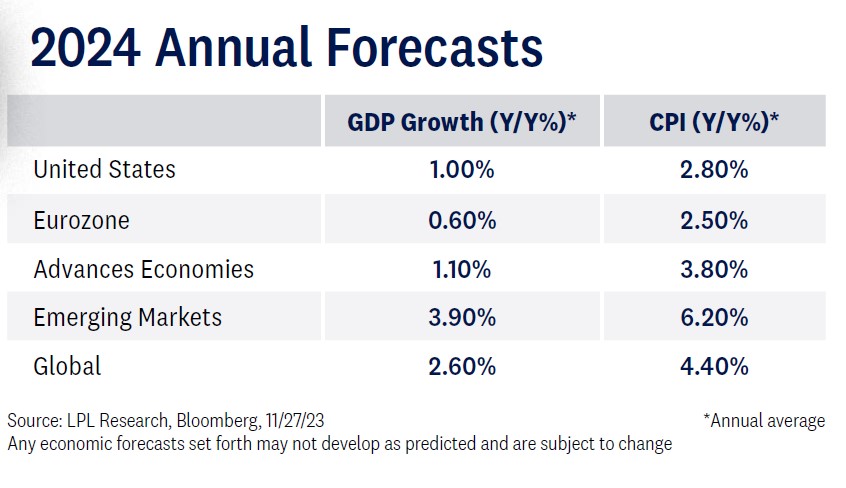

The economy grew faster than expected in recent quarters, unemployment remained historically low, and activity in some sectors grew (e.g., homebuilding), despite the macro headwinds. The labor market seemed to be a boon for workers in prime positions to bargain for better pay and more benefits. In 2024, we believe a recession is likely to emerge as consumers buckle under debt burdens and use up their excess savings, but a Fed that is sensitive to risk management might provide an offset by taking interest rates down again in the new year. Inflation may remain a concern, but the Fed will likely be less laser-focused given the trajectory is going in the right direction. In sum, we expect a mild recession to occur in 2024, although that may usher in some interest rate decreases from the Fed and offset some of the economic and market impact.

Turning points are often marked by a series of significant events, but it’s also valuable to put those events in context. For the U.S. economy, the event that might accompany this time of change could be a recession. However, if we look back on the post-pandemic economy, many things have gone better than expected.

THE RECESSION CALL

The economy grew faster than expected in recent quarters, unemployment remained historically low, and activity in some sectors (e.g., multi-family homebuilding) grew despite the macro headwinds. And then there was the labor market. It appeared to be a boon for workers, who seemingly have been in prime positions to bargain for better pay and more benefits.

The efforts to combat inflation have also turned out better than expected. Inflation continues to slow down and so far; the Fed’s efforts have not caused as much pain as Chairman Jerome Powell had warned earlier in the tightening cycle. By the time we enter 2024, the Fed will have pushed the fed funds target rate up 5.25 percentage points to reach an upper bound of 5.50%. While we’ve felt the pain of higher interest rates, easing inflation will help the Fed pivot to a more wait-and-see approach. Committee members will likely view the risk of raising rates to be in balance with the risk of not raising them enough.

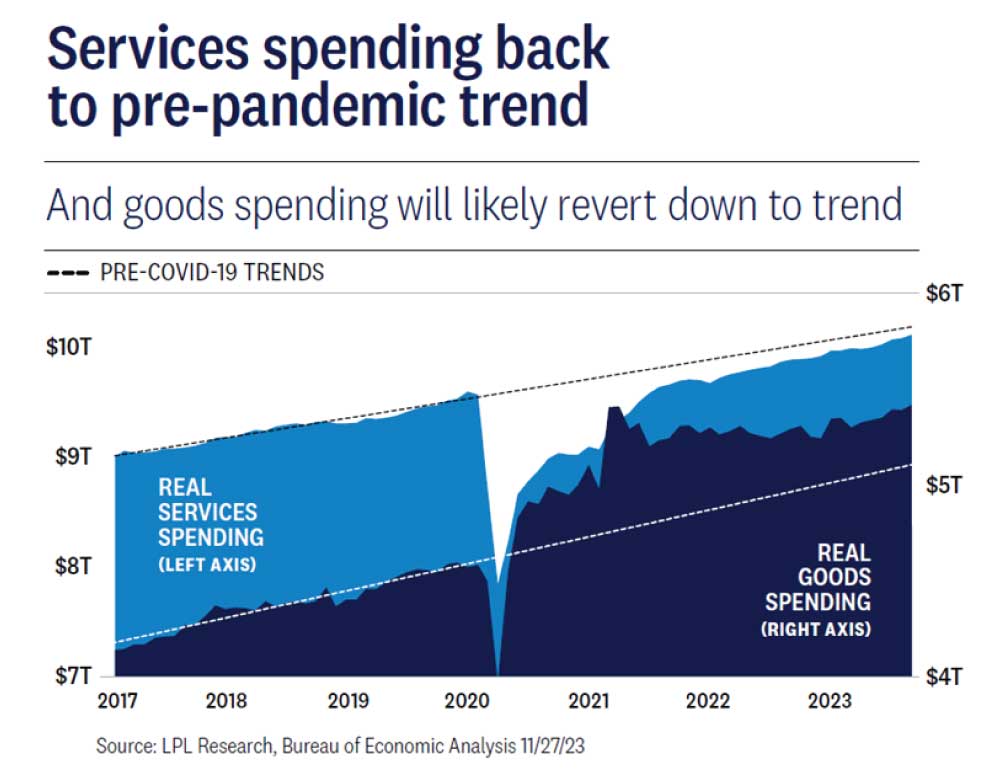

The key here is deciding to what degree the Fed rate-hiking campaign will affect the broader economy. We believe a recession is likely to emerge in 2024 as consumers, under increasing debt burdens, deplete their excess savings and are no longer able to keep up with debt payments. Leading indicators that we’re watching include an increase in serious delinquencies in credit cards and auto loans. We expect the spending splurge to end, with consumers reverting to trend.

In 2024, the consumer will no longer be willing to spend, as they did in 2023. However, a Fed that’s sensitive to risk management might provide the salve necessary for more risk appetite. Investing is a relative game, meaning the U.S. could experience the “3 Ds” of an economic contraction—depth, diffusion, and duration (the three things needed for a recession)—but at the same time, still outperform other markets.

What we are indicating here is that while recession is our base-case call for 2024, that does not mean equity investments should be off limits. So, while a recession could be an event that marks this turning point, in context it could turn out better than expected. A shallow recession would increase the odds that the Fed will cut rates, and it would bring the labor market into better balance. And as history shows, markets tend to do well when the Fed pivots from higher rates and beings to lower them again. In fact, we believe the most likely outcome in 2024 is a scenario in which the stock market looks past the negatives of recession.

WHAT TO WATCH FOR IN 2024

Inflation remains top of mind. Although it’s come down, especially as services inflation cools, there’s a portion that persists. The surge in rent prices was a key driver of headline inflation in recent months, but its impact will likely wane soon as rent prices are off their peak, according to industry reports. It’s also important for investors to remember that there is a sizable lag in time between a reported movement in rental data and the official government metrics. Excluding housing, core inflation is more benign. Clearly, the inflation experience of homeowners is quite different than the experience felt by renters.

Turning to the Fed, we expect to see a Fed focused less on inflation and more on the other part of their dual mandate—stable growth. As already highlighted, inflation will still hover above the 2% long-run target and remain a concern, but the Fed will likely be less laser-focused given that the trajectory is going in the right direction.

Meanwhile, interest rates will no longer be defined by abnormal lows or extreme highs. If the economy slows as predicted, the Fed will likely start discussing plans to cut rates. Keep in mind, those cuts may not come until the latter half of 2024, and the magnitude may not be anywhere near as aggressive as markets thought just a year ago. The mantra of “higher for longer” indicates expectations that the Fed will avoid the mistake it made in previous periods when interest rates were near zero. When rates are that low, it can lead to other issues, with policymakers left with one less tool at their disposal to create accommodative financial conditions in the event of a major financial crisis. So, despite the potential for a recession, the Fed probably will not cut rates aggressively, which would mean relatively higher rates would continue throughout the year. Still, we could see the fed funds target rate down to 4.50% by the end of the year, which would suppress both mortgage rates and the 10-year Treasury yield.

THE REAL ESTATE MARKET

The real estate market remains something to watch, reeling from the unintended impacts of remote and hybrid work and high borrowing costs. With this work environment, people aren’t necessarily pressured to relocate and buy homes in certain parts of the country. As a result, one unintended consequence of remote or hybrid work is an economy less sensitive to interest rates. Historically, tighter monetary policy translates to higher mortgage rates. In turn, this slows the real estate market and cools house prices.

Based on the current environment, however, home prices probably won’t normalize much due to lean inventory and buyers who come to the closing table with cash. As households move from higher cost of living areas to lower, those with home equity now have the cash to use it toward a home, which means they skirt the credit markets. These buyers continue to generate demand and, in turn, contribute to keeping home prices up. The combined effect of these factors could mean we remain in this environment of higher home prices.

THE JOB MARKET

When it comes to the job market, some call the recent shift in favor of the average worker the democratization of the workforce, considering that workers have rarely had this much bargaining power. As the American worker has had a few years to adjust to the hybrid work model, we should continue to see a fair amount of turnover. Some have seen the fastest way to higher pay is moving to a new job. Of course, the hybrid model can only operate in some sectors, so its impact varies depending on the industry.

Further, many regions of the U.S. have passed pay transparency laws that require firms to disclose the salary range for job openings, meaning some firms will have relative difficulty finding qualified workers if not offering competitive wages. Even with the risk of an economic downturn, we do not expect a material rise in the unemployment rate. For many workers, this environment undoubtedly further establishes their position in the driver’s seat when it comes to market power.

POTENTIAL UPSIDE

With a macro backdrop such as this, where could investors see a surprisingly favorable turn of events?

A Fed entering a new period of policy easing, homebuilders able to capitalize on the unique macro environment, and workers in a historically strong position could all set up markets for a better-than-expected outcome despite a short and shallow recession.

Stay tuned for more in the coming weeks as we preview more of what to expect in 2024.