Turning Dispersion and Volatility into Opportunities

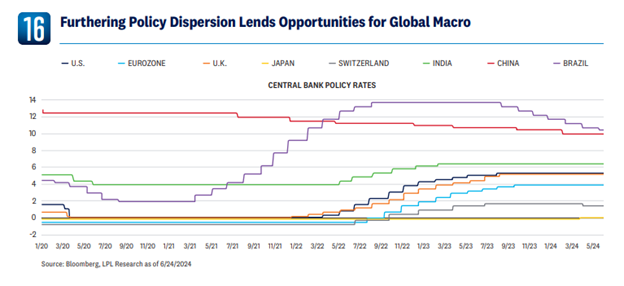

We came into 2024 with two key considerations in mind — greater micro and macro dispersion and asset volatility. We witnessed the unfolding of the micro and macro dispersion (an increasing gap between best- and worst-performing economies and assets) during the first half of the year, which translated into a healthy trading environment for many liquid alternatives (Alts) and hedge fund strategies. Global macro was a standout as it monetized the accelerating de-coupling of the global economy and policy actions, as well as equity market neutral managers (small overall net exposure to the stock market) which delivered positive outperformance from both long and short positions.

Looking ahead, we expect market divergences to continue and volatility to pick up. At the macro level, major central banks have become more vocal about how each region will take independent action from one another and have taken their initial steps towards their goals. They will continue to decide their own path, which should bring about greater macro divergences. This is not just a story about developed-market countries either. Emerging market economies have also begun to unlink themselves from one another, making dispersion a global phenomenon.

At the micro level, the decline in correlations among index components shows that rates and momentum are taking the backseat as fundamentals take over as the primary driver. Asset volatility has drifted lower during the first half of the year, but with uncertain paths of inflation and economic health globally, potential weakening momentum in the equity market, a busy global elections calendar, and many other geopolitical risks that are yet to be resolved, we anticipate volatility will begin to move higher.

For this reason, we maintain our focus on those alternative strategies that are nimble, can generate outperformance from both top-down macro as well as bottom-up fundamental factors, have limited market sensitivity, and can benefit from a rise in volatility. Given the uncertainties mentioned, we believe this is also the time to be more focused on balancing return generation goals with downside risk management.

Among liquid Alts and hedge fund strategies, we remain constructive on global macro strategies that have demonstrated their ability to capitalize on market and policy divergences. Within global macro, we encourage investors to look into multi-strategy approaches with truly diversified asset classes and regional exposures, as the markets move away from directional structural themes, such as interest rate curve steepeners, to more shorter-term tactical trading across both developed and emerging markets.

Managed futures were another leading performer in the first half of the year. We continue to believe the strategy serves as a solid portfolio diversifier that deserves a steady allocation. While trend followers have led the pack in recent months, we expect shorter-term focused multi-strategy managed futures to show their resilience as they adapt quicker in the evolving macro landscape. Lastly, we believe the current equity market environment offers a greater stock-picking environment for market-neutral managers. With rich valuations and potentially diminishing momentum, these managers should be able to build solid portfolios of short positions to offset their longs and increase their potential to outperform.

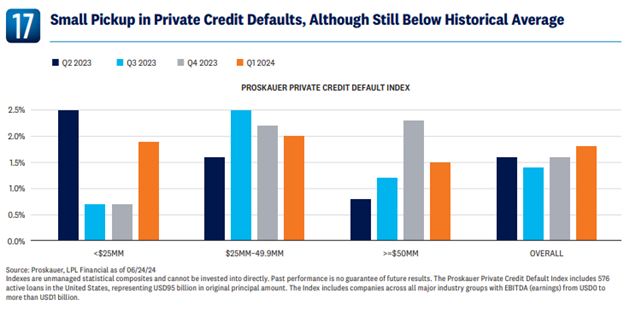

Among private market strategies, private credit and infrastructure strategies, which we were constructive on, continued to perform well and are expected to continue to show their resilience. Private credit continues to offer attractive yields, although spreads have tightened slightly with an increase in competition and low default rates. That said, with the uncertain timing and size of the Fed’s cuts, we are mindful of the potential stress that high borrowing costs could place on businesses and the overall sector. Given sufficient yields on high-quality loans, focusing on portfolios with senior secured loans with low leverage should help mitigate the potential risks such stress can bring on.

Within the private credit market, we also favor portfolios with flexible and broader mandates that can diversify their positions beyond direct lending and participate in unique opportunities, such as asset-based lending and distressed/special situations. Infrastructure’s tendency to hold its value across the cycle and their rate and inflation-linked yield should be appreciated in times of higher global turbulence. The secular tailwinds of digitalization, decarbonization, and related government support remain strong as well, which should aid the infrastructure segment.

The Bottom Line:

As expected, 2024 has seen a rise in market dispersion, creating opportunities for skilled active managers in the alternatives space. Moving forward, we anticipate this trend to continue and volatility to begin to rise more meaningfully as well. This environment will favor certain strategies that can capitalize on both broad economic trends and micro fundamentals. Over the intermediate and long-term, by incorporating strategies like global macro, multi-strat, and managed futures, we believe investors may benefit over those who strictly maintain a traditional stock/bond allocation.