For the first time in over 10 years, we’re seeing new growth opportunities in the fixed-income market. Some might say the turning point for bonds is a return to normal, one where investors can expect decent returns without the risk that comes with stocks. This is a key reason we believe investors can feel confident about bonds for 2024.

RATES LEAD THE WAY

U.S. Treasury yields moved higher in 2023 with the interest rate on the 30-year Treasury bond briefly trading above 5% for the first time since 2007. The steady increase in interest rates (which makes bond prices go down) hit the intermediate and longer-term Treasury bonds the hardest. There are several reasons we saw higher yields, but rates moved higher alongside a U.S. economy that continued to outperform expectations. As the U.S. economy continued to perform better than expected, interest rates went up, and the chances for a recession went down, which in turn led the Fed to stick to its “higher for longer” approach—rather than lowering rates to stave off a looming recession.

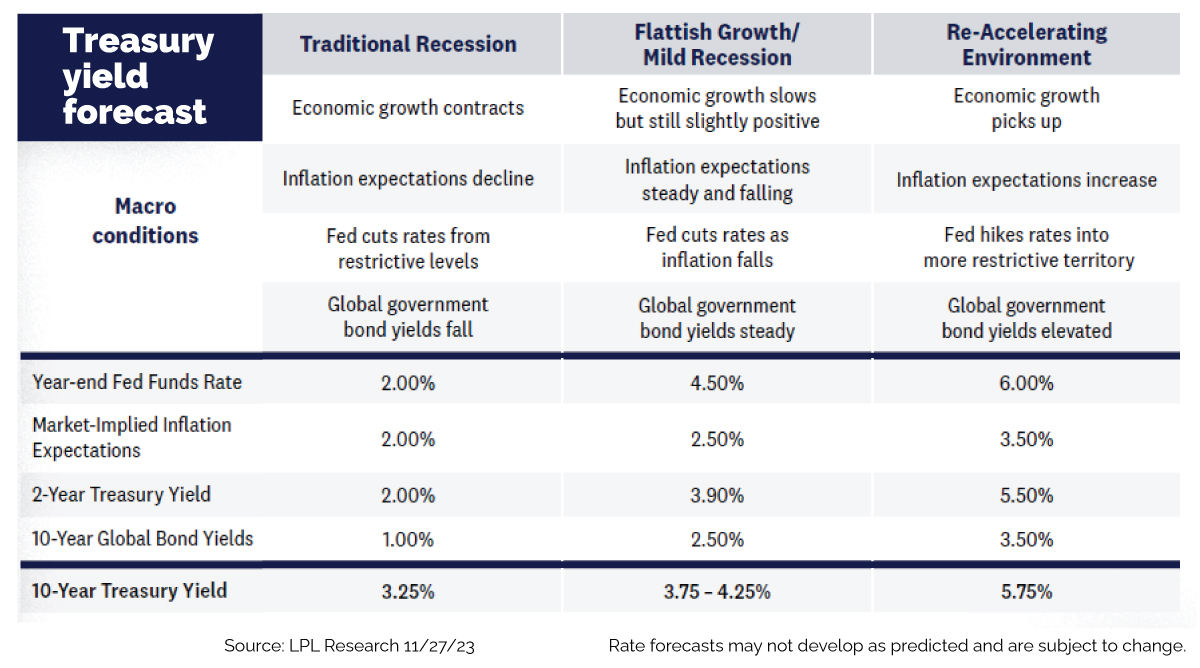

As the economy has continued to be better than expected, we have witnessed some spikes in Treasury bond yields. While we think the 10-year Treasury yield could stay mostly in the 3.75–4.25% range for 2024, a softer economy could put further downward pressure on yields.

WHAT’S OLD IS NEW AGAIN

Just as we study history to understand how societal and political trends change, we can also learn from a historical view of interest rates. Examining interest rates over a longer time horizon can help us determine what could be considered normal and gives some insight into where rates could go, should we not get the recession we are expecting.

Data from 1880 shows that interest rates were consistent before they spiked in the 1980s, driving 10-year Treasury yields up with them. In fact, long-term rates mostly traded within a 3–5% range for nearly a century before moving aggressively higher as the Fed fought generationally high inflation. Periods above that 3–5% range occurred when the economy was growing with high inflation, which shaped the Fed’s interest rate policy (economic growth + low inflation = normalized interest rate policy). Indeed, the sharp increase in the 10-year yield over the past few years puts the yield firmly back into the normal, historical range.

THE WATCH FOR A BUYER STRIKE

If you were hoping the recent Fitch downgrade of U.S. debt would serve as a wake-up call to Washington, it hasn’t. Since the debt ceiling debate was resolved last June, the Treasury Department has steadily increased the amount of Treasury debt outstanding. As of September 30, total debt outstanding stood at a record $33.2 trillion, which is up from the $31.5 trillion right before Congress gave the Treasury Department unfettered borrowing capacity through January 2025.

The Congressional Budget Office expects the U.S. government to run sizable deficits over the next decade, and to fund those deficits, the Treasury will need to issue debt. This will happen at the same time the largest owners of Treasury securities (the Fed, Japan, and China) are generally reducing their impact in the Treasury market. If global central banks continue to slow down their presence at our auctions, the country will be dependent on private institutions to bid at auction. But unlike central banks, the private sector is more focused on prices and thus may require higher yields. It’s important to remember though, if Treasuries are considered risk-free securities, there will always be buyers. The question is price. At what price would it take for more price-sensitive buyers to get interested? So far, we haven’t seen a drop off during Treasury auctions. But there could be eventual fatigue, which would mean yields would need to increase (or at least stay elevated) to attract that additional demand. While prices have been volatile, we believe there will always be some demand for Treasuries, especially if the Fed reduces interest rates in 2024.

CRACKS IN THE CORPORATE CREDIT MARKET?

The corporate credit markets have been resilient so far in this cycle, with credit spreads (or the additional compensation for owning risky debt) remaining around historical averages. However, with the increase in Treasury yields over the past few years, corporate interest payments are set to increase as well. And while the health of the corporate landscape is generally positive, rating agencies are starting to adjust their outlooks based on the expected increase in debt payments, among other things.

The ratings environment remains relatively calm for companies across investment grade (from AAA to BBB-). However, lower-rated companies (BB+ to CCC-) have taken the brunt of downgrades and will likely continue to in the coming quarters. By October 2023, S&P had downgraded its outlook and the outright rating on 814 companies (both investment grade and high yield) with only 512 upgrades. Numbers like these mean that by the start of Q4 2023, the year was already the worst for downgrades over the past 10 years (excluding 2020).

With the higher for longer narrative coming from the Fed, corporate debt payments will likely continue to stay elevated. And while many corporate borrowers took advantage of low interest rates and issued a lot of debt, refinancings are set to pick up at currently higher rates. As such, we remain cautious on corporate credit broadly, but we think the short-to intermediate part of the investment grade corporate credit curve offers compelling risk/reward. However, we still don’t think the risk/reward is very attractive for high yield or bank loans given the broader macro and refinancing risks, which will likely keep rating downgrades and defaults elevated. Of course, nothing is ever certain in the markets, but there will be opportunity for investors who choose their credits wisely.

PUTTING IT ALL TOGETHER

The move higher in Treasury yields over the past few years has been unrelenting, with intermediate and longer-term Treasury yields bearing the brunt of the more recent moves. Economic growth surprised to the upside in 2023, which means that the Fed will likely keep short-term interest rates elevated for longer until economic data begins to soften.

However, with yields back to levels last seen over a decade ago, we think bonds are an attractive asset class again. There are three primary reasons to own fixed income: diversification, liquidity, and income. And with the increase in yields recently, fixed income is providing income again.

Right now, investors can build a high-quality fixed income portfolio of U.S. Treasury securities, AAA-rated agency mortgage-backed securities (MBS), and short-to-intermediate investment grade corporates that can generate attractive income. Investors don’t have to “reach for yield” anymore by taking on a lot of risk to meet their income needs. And for those investors concerned about still higher yields, laddered portfolios and individual bonds held to maturity are ways to take advantage of these higher yields.

Thank you for reading and Happy New Year! Stay tuned for more from our outlook next week as we review geopolitical impacts.